DRAFT

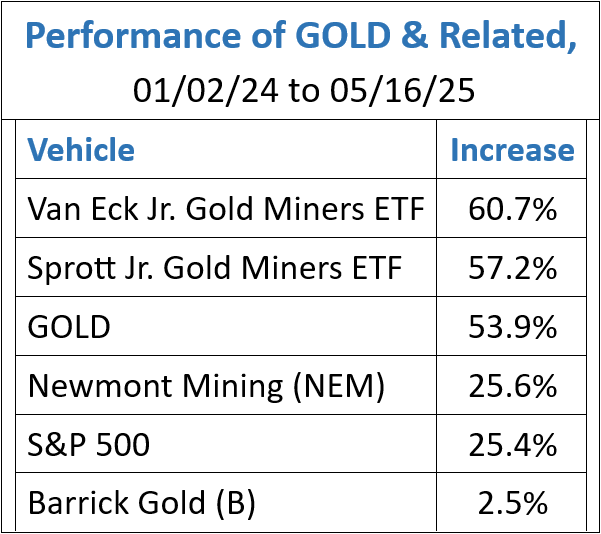

Since the beginning of 2024 the Sprott Junior Gold Miners ETF (SGDJ) and the Van Eck Jr. Gold Miners ETF (GDXJ) have outperformed Gold and the world’s two largest publicly traded gold miners. The table below depicts the performance of gold, gold related investment vehicles and the S&P 500 from the beginning of 2024.

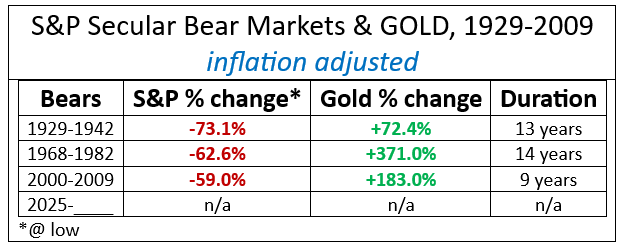

Based on my research findings in the table below gold is projected to continue to steadily climb to new highs. The table below depicts that gold outperformed the S&P 500 for all of the index’s secular bear markets since 1929. Based my research of all secular bears since 1871 gold is projected to continue to steadily climb to new all-time highs until at least 2034. For more on the secular bear see my 03/17/25 “Secular Bear Underway, How 80%+ Decline for Dow & S&P Possible?”.

The two ETFs are projected to continue to outperform gold and the shares of the two companies for the foreseeable future. Its because of my discovering the cause for the severe depression that the Jr. Gold miner shares have been experiencing. The sector is well positioned to be the top performing publicly traded sector through 2034.

The risk reward ratio for Junior Gold Miners sector is the best that I come across since my career began with Merrill Lynch in 1977. Throughout my 48 years it’s the only industry/sector/asset class for which 100% of its members simultaneously have share prices at or near all-time lows. What is especially telling is the sector has hundreds and possibly even more than 1,000 publicly traded members.

After analyzing gold and the companies which mine the precious metal there is only one logical conclusion:

“Junior Gold Miner Shares are INSANELY undervalued and the Demand coming for them will be INSANE”

All of the members of a commodity producer’s sector having share prices at or near their all- time lows with the price with the price of the producers’ commodity being simultaneously at or near an all-time high is unprecedented. This paradox is extreme and its for the ages. The probability of it ever being repeated is remote.

My recommendation is for 15% of a portfolio’s liquid assets be invested in Jr. gold miners for two reasons:

-

- The miners are an alternative for investing in gold which is the premier safe haven asset.

- Extremely depressed and historically unprecedented share prices for miners present a “once in a multiple lifetimes opportunity”.

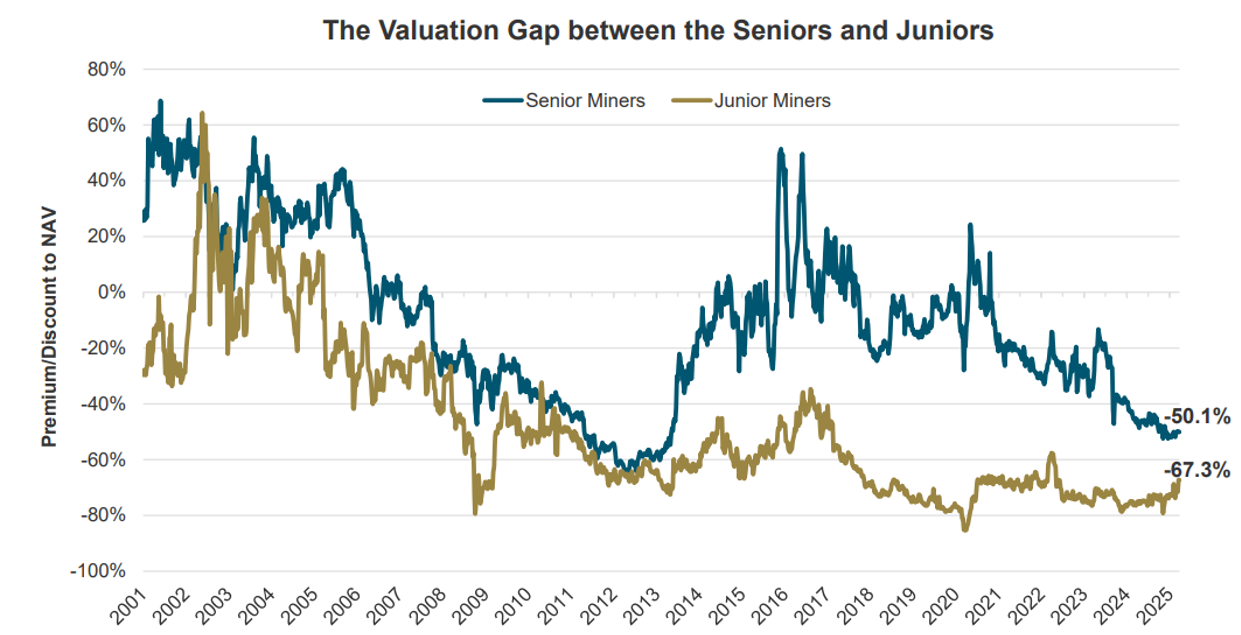

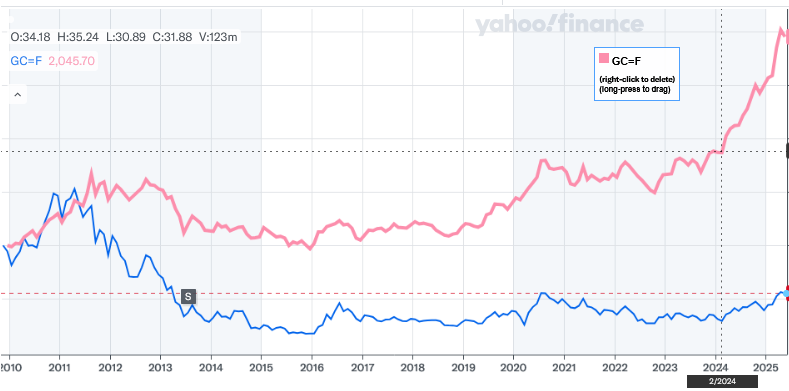

The chart below depicts the underperformance of the Junior gold miners vs. the Senior gold miners from 2013 to 2024. From 2003 to 2013 the performance of the two sectors was highly correlated. For the first two years of the 2000 to 2009 secular bear the juniors substantially outperformed the seniors.

Source: Sprott ETFs

The reason for why the performance of the Senior and Junior gold miners diverged was because of the US’ Dodd Frank Act which was signed into law by President Obama in July of 2010. Dodd Frank was created or intended to be the solution to prevent another 1929 or 2008 circa crash.

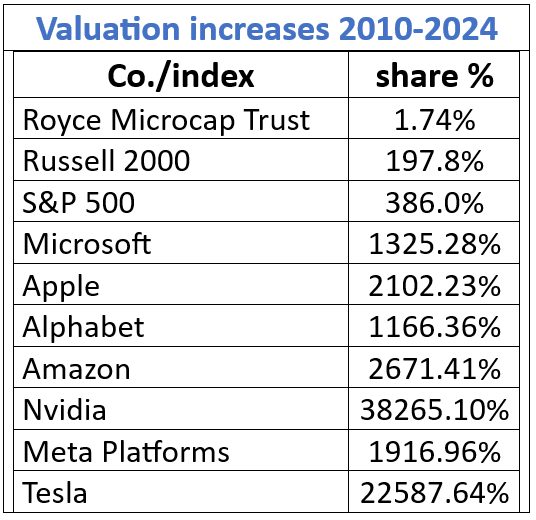

The act substantially changed the landscape for the U.S. capital markets. It was because the liability for U.S. stock brokers and other financial professionals for client losses went from civil to criminal under Dodd Frank. This resulted in all financial professionals selling and since then avoiding all non-blue chips. They instead invest exclusively in the safest name brand companies which include the world’s largest technology companies.

The table below depicts the underperformance of the US’ indices and seven largest technology companies. The Royce Microcap Trust, the ETF which contains low price shares and micro-cap companies, had the worst performance. For the 14 years since Dodd Frank was enacted the trust increased by a paltry 1.74%.

Dodd Frank was absolutely the cause of the significant damage to the valuations of all mining stocks worldwide. It’s because all publicly traded global mining companies either list or co-list on a U.S. exchange. The US also contains the largest pool of professional investors. The Junior Gold Miner sector by its very nature is considered to be very high risk. The chart below depicts the gold mining stocks to gold ratio holding at its 25 year low since 2015.

Source: Sprott ETFs

The deeply oversold and unloved Junior gold miner ETFs have outperformed gold and the senior miners since 2024 for two reasons:

1. Steady increase in the mergers and acquisitions of the Jr. gold miners held by the ETFs.

2. The sector has two dedicated ETFs which provide professional investors with access to the sector

Jr. gold miners are being merged and acquired

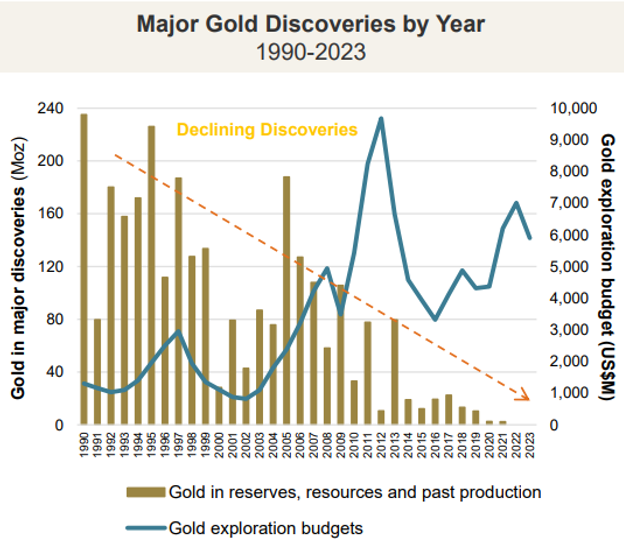

The junior gold miners steadily declining share prices resulted in them becoming acquisition candidates. The extremely low share prices and valuation made it much easier for the elder miners to acquire them instead of risking capital to discover new claims. The chart below depicts the peak for gold discoveries occurred in 1990. Chart also depicts that exploration budgets peaked in 2012. Thus, the value of all staked claims that have not yet been produced have been and will continue to steadily increase.

Source: Sprott ETFs

The always cash strapped junior gold miners are unique in that they have an overwhelming amount of unproduced claims. The irony is that Dodd Frank, in making it difficult for junior minors to raise capital to develop their claims, significantly increased the value of the claims held. From when Dodd Frank was enacted to May 18, 2025, the date of this report an ounce of gold increased by 191%.

My research of the news pertaining to junior gold miners being acquired netted a plethora of articles and news releases. The paragraph below was pulled from a 12/19/24 article on Yahoo Finance entitled “The biggest mining deals in 2024”:

“According to industry analytics from Mining Technology’s parent company, GlobalData, to date there have been 754 acquisitions totaling $99.73bn and 30 mergers totaling $2.43bn announced in the mining sector in 2024.”

Below are some additional articles pertaining to the mergers and acquisitions for Jr. gold miners over the last six months:

“Mining M&A Surge: Opportunities & Strategies for Investors in the Gold & Copper Sector”, October 22, 2024

“Gold surge ignites takeover buzz for junior miners at Denver forum”, November 6, 2024

“Q3 2024 update: M&A activity in mining in North America”, December 2, 2024

“WHY WE ARE DUE FOR A JUNIOR MINING STOCKS UP-CYCLE”, January 10, 2025

“Why merger mania is coming to the fore in the mining industry”, January, 20, 2025

“Is the mining industry on the verge of a new M&A cycle?”, January 29, 2025

The increased merger and acquisitions activity is one of the two reasons for why ETFs have been able to outperform gold and also the senior miners since 2024.

Sector dedicated ETFs provide access to professional investors

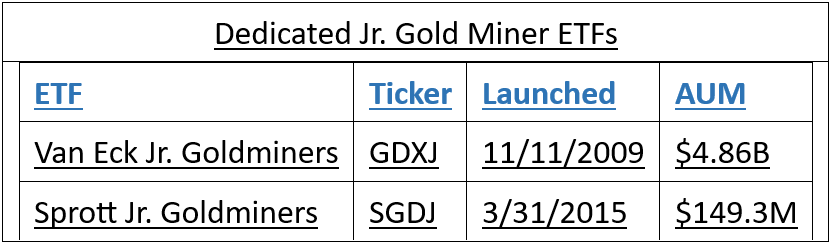

The outperforming ETFs themselves, are the key for why they will continue to outperform and also for why a majority of the gold miners in the sector will eventually outperform. The table below contains information about the ETFs.

The ETFs which have an aggregate of $5 billion of assets provide an alternative for professional investors to invest in the Jr. gold miner sector without having to invest directly in each company. The ETFs have removed the Dodd Frank risk from the equation. Discovering the ETFs is the primary reason for my “Junior Gold Miners will be among or be the top performing publicly traded sector until 2034” prediction.

The answer to the obvious question for why the Van Eck ETF, which was launched in 2009, did not begin to outperform until January of 2024 is because from 2009 through 2024 gold was an underperformer. The chart below depicts the performance of the Van Eck ETF and gold from 2009 to 2025. It depicts that gold did not break out to a new significant all-time high until February 2024. The “new high” headline was the catalyst that drove demand for the shares of the two Jr. gold miner ETFs and also increased the values of the ETFs’ holdings.

Because of Dodd Frank any and every deeply undervalued sector needs to have an ETF that is dedicated to it. One or more dedicated ETFs enable a sector to consolidate via mergers and acquisitions instead of bankruptcies and restructurings being utilized.

For the Jr. gold miners sector the ETFs provide the vehicle or the facility for rapid consolidation. As the companies the ETFs hold are acquired the cash will be available to purchase the shares of the remaining undervalued junior gold miners. Sector dedicated ETFs are ideal for the wash, rinse and repeat cycle that is needed by the Jr. gold miner sector to consolidate the hundreds of small and extremely undervalued members.

The cycle will create a feeding frenzy for the ETFs and the securities of all of the members of the Jr. gold mining sector. Buyers of junior gold mining shares will include:

- Sr. gold miners

- Jr. gold miners aspiring to become Sr. gold miners

- Individual investors

- Professional investors

- Sector dedicated and other mining ETFs

My prediction is for the assets managed by the two ETFs to increase significantly. It’s because the demand by especially institutional investors for the ETFs will increase steadily and significantly.

The shares of the existing Sr. gold miners will continue to underperform due to the dilution that will be caused by the acquisitions. Sr. miners will utilize both cash and shares to make acquisitions.

The overarching factor for the demand for the securities of all of the Jr. gold miner sector‘s members including the ETFs to increase steadily and substantially is the secular bear market that began in February 2025. Gold has withstood the test of time and has been a reliable safe haven and defensive investment during volatile economic conditions and the S&P 500‘s secular bear markets. The rationale which explains why gold is an ideal asset class to hold for a secular bear market is contained in the highly recommended video below.

Jr. Gold Miners, Ideal for Secular Bear Market Now Underway

For more on the secular bear see my 03/17/25 “Secular Bear Underway, How 80%+ Decline for Dow & S&P Possible?”

My plan is to begin to conduct continuous research to identify the junior gold miners which are the most deeply undervalued. Qualifying companies will be added to www.savechangeworld.com and coverage will commence. The companies will also be presented and the CEOs will be interviewed during the weekly “Markowski on the Markets” (MOTM) ZOOM sessions. Sessions are held every Saturday at 11:30AM EST. Register to receive the complimentary ZOOM links and to have access to the recordings below.

The plan is also to develop and manage a list of the Jr. gold miners which are regularly ranked by upside potential. For access to the list of the Jr. gold miners register below.

Discovering the cause for Jr. gold miner shares @ all-time low, gold @ all-time high paradox ranks among my top four extreme events for companies or sectors that I have researched since 1984. See events table below.

|

Year |

Event/Anomaly researched |

Result |

|

1984 |

250 stocks increasing by a median 19 times from 1974 to 1983, a period which encompassed 1968-1982 Secular Bear |

Identified and underwrote adult day care co., was acquired by United Healthcare, +1700% gain |

|

2001 |

Enron’s pre bankruptcy SEC Filings, Record EPS and all buy and no sell recommendations by analysts had preceded its infamous bankruptcy |

Predicted collapses for a dozen blue chips including Lehman, Bear Stearns & Merrill Lynch |

|

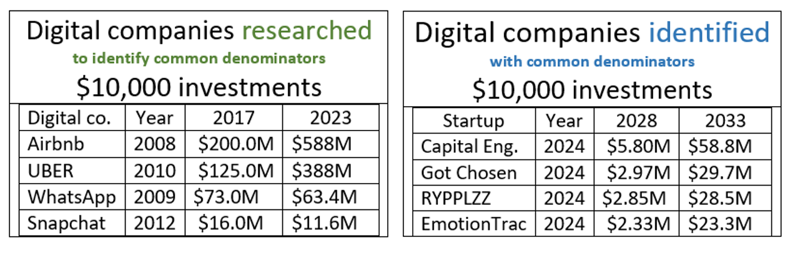

2017 |

Four digital companies. $10,000 in each from 2008 to 2012 valued for $16-$200 million by 2017. See table below |

Identified four digital companies. $10,000 in each projected at $2.3 million to $5.8 million by 2028 |

|

2025 |

Jr. gold miners sudden outperformance vs. Sr. gold miners and gold, Why shares @ all-time low, gold @ all-time high paradox? |

Prediction for Jr. miner to be top performing publicly traded sector |

Finally, this report is on par with my “Have Wall Street’s Brokers been Pigging Out?” Equities Magazine article. It was available on newsstands in September 2007. The article contained my prediction for the collapses of the five largest U.S. brokers including Lehman, Bear Stearns and Merrill Lynch. The prediction for the brokers was my best ever. My prediction for the Junior Mining Sector has the potential to be my best ever.

Michael Markowski, Director of Research for SaveChangeWorld.com. Developer of “Defensive Growth Strategy”. Entered markets with Merrill Lynch in 1977. Named “Top 50 Investor” by Fortune Magazine. Formerly, underwriter of venture stage IPOs, including one acquired by United Health Care for 1700% gain. Since 2002 has conducted empirical research to develop algorithms which predict the negative and positive extremes for the market and stocks. Has verifiable track records for predicting (1) bankruptcies of blue chips, (2) market crashes and (3) stocks multiplying by 10X. In a 2007 Equities Magazine article predicted the epic collapses for Lehman, Bear Stearns and Merrill Lynch. Most recent algorithm developed from research of UBER and AirBnB has enabled identification of startups having 100X upside potential within 7 to 10 years. Video (3 minutes, 53 seconds) covers Mr. Markowski’s research to develop predictive algorithm methodology.