Based on my research of the S&P 500’s performance vs. the CPI from 1871 to 2020, the index will experience an epic crash in 2024. Decline will range from 32% (1920-21) to 85% (1929-1932) compared to the index’s all-time intraday high of 4816. The catalyst for the crash will be the deflation that is currently underway in the U.S. and throughout the world. See “Chinese Price Gauge Shows Longest Deflation Streak Since 1999”. The resulting instant layoffs that will be caused by the deflation which will be accompanied by the infamous crash will be the catalysts to cause the US to enter into its 3rd Great Depression. Please note. Deflation is masked due to CPI computation change. Continue to read more and view video below.

The U.S. Federal Reserve Bank surprised the world when Fed Chairman Jerome Powell announced on December 13th that the Fed would begin to lower its discount rate in 2024. Global investors responded by bidding up the U.S., European and Asian stock and bond markets. The news about the Fed propelled the S&P 500 to within 1% of its January 2022 high. The Dow Jones composite reached new all-time high in December 2023.

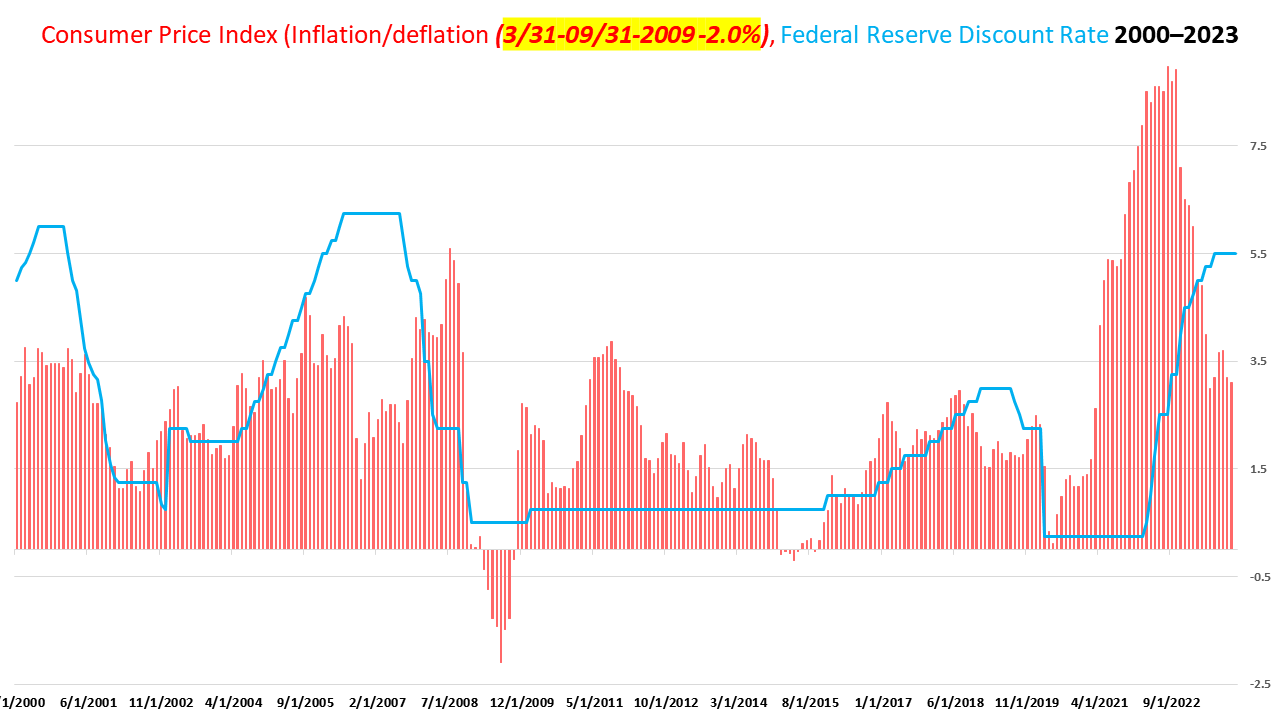

Professional investors and thought leaders were stunned by the Fed’s revelation. After the Fed’s discount rate peaked at 5.5% in July of 2023, the Fed had adopted a “high for longer” mantra as recently as September 2023 for its discount rate policy. For the Fed to introduce the possibility of discount rates in 2024 with U.S. GDP having increased by 4.9% in the third quarter and inflation not yet at 2% was TELLING!

My suspicion was that something was amiss. Something had happened to the U.S. economy that only the Fed was seeing and not sharing.

CNN had reported that the Wal-Mart CEO predicted that food deflation would soon arrive during the company’s scheduled November 16, 2023 earnings call. My research efforts to determine why the Fed pivoted were focused on deflation.

The July 19, 2023, Business Insider article, “Disinflation will shift to deflation, hitting earnings and sending stocks lower, Morgan Stanley CIO says” was discovered. The article was about Morgan Stanley’s all-star analyst Mike Wilson warning about the risk of deflation.

Coincidentally, on December 13, 2023, the same date of Powel’s post Fed Meeting press conference CNBC published “Here’s where deflation was in November 2023 ─ in one chart”. The article listed a couple of dozen food, energy and miscellaneous items for which prices declined in November of 2023 as compared to November of 2022. The table below depicts the items for which prices declined by at least 10%.

What was surprising was that CNBC’s Senior Economics Reporter did not ask Fed Chairman Powell about “deflation”. Mr. Liesman had a chance to do so during Mr. Powell’s press conference. No questions about deflation were asked by anyone who attended the Powell press conference.

Throughout the first half of 2022, my research had been focused on the CPI and the effect that inflation and deflation had on the S&P 500 from 1871 to 2020. Research was also conducted on the Federal Reserve’s discount rates and policies since the Central Bank was founded in 1913. My research findings that are available in my 2022 report “Federal Reserve’s Repeat of 1920−1931 Policy Mistakes Set Stage for Next U.S. Great Depression” indicated that the probability was high for the US to enter into its 3rd Great Depression.

The 10:53 seconds video below “Fed’s 2021 Repeat of 1919 Policy Mistake Spells DEFLATION-DISASTER” was produced on 12/23/23. It covers the FED repeating its 1920-21 policy mistake in 2020-21. The 1920-21 mistake transformed a recession into the first U.S. Great Depression.

The major indices moving to above or to near all-time highs after the Fed’s last 2023 meeting is for two reasons:

- Analysts and investors have no experience with deflation and the significant damage it can cause to a stock market and an economy. Extended deflation and the negative effects it had on the economy and the markets was last witnessed from December of 1930 to June of 1932.

- The deflationary period that began in 2023 is not yet visible because it is masked by a change for the computation of the CPI in 1982. For more about this change view video below:

The chart below depicts the last two extended periods in which deflation was at or above 6%, [03/1921-05/1922] and [12/1930-06/1933]. From its July 1919 peak the S&P 500 declined by 32% and reached its bottom in August 1921. The index declined by 86% from its 1929 high and bottomed at its all-time low in June 1932. Both of the bottoms occurred near their deflation peaks.

The above chart and charts in this report are from my report that covered the two policy mistakes made by the Fed to cause the 1st and 2nd Great Depressions. The report also explained that the Fed had repeated both of the policy mistakes in 2020 and 2021.

The most dangerous of the two mistakes that were made from 1920-1928 was 1920-21. The chart below depicts the Fed hiking the discount rate to 7% during a recession (gray shaded area).

The chart below depicts the increasing of the rate transforming the recession into a depression (gray and bronze shaded areas).

The chart and table below depict the damage caused by the 1st Great Depression (1920-1921). Unemployment tripled from 4% to 12%. US Industrial Production from February of 1920 to March of 1921 declined by 33%. Deflation is extremely dangerous because when prices decline the manufacturers of products immediately:

-

Cease manufacturing additional products

-

Layoff the employees who produce the products

The decline for manufacturing during a deflationary period is exacerbated. Manufacturers have a buildup in excess inventories due to the root of the ensuing deflation being a significant reduction in demand.

The current deflation period and resulting 3rd U.S. Great Depression is likely to mimic 1919-1921.

It’s because the extreme deflation high of ─15.79% that occurred after the 1st U.S. Great Depression began followed an extreme inflation high of 23.67% in June of 1920. For the 2nd Great Depression, the inflation rate that preceded deflation peaked at 1.17% in July of 1929. The highest deflation rate for the 2nd Great Depression was ─10.74%.

The chart below depicts that inflation in February 2022 soared to 7.87% from 0.12% in May 2020 before the Fed initiated a rate hike in March 2022, its first since 2018. It confirms that the Fed made in delaying its hikes repeated the same mistake that it made from 1919 to 1920.

The deflation that is depicted in the above chart from March to September of 2009 is a good example of how a market crash (Crash of 2008) causes a significant decline in consumer and capital spending. The two are the main ingredients to cause an economic depression after a market crash.

The chart below depicts the extreme highs for inflation that were followed by the extreme highs for deflation from 1881 to 1913.

There have not been any modern-day instances of extreme inflation followed by extreme deflation. However, there have been periods of extreme CPI volatility. After inflation reached 14.76% in 1980, the highest level since July of 1920, the consumer price index declined to a low of 8.92% in 1981 and to 3.83% in 1982. My research confirmed that periods of accelerating inflation are followed by periods of decelerating inflation and deflation.

Viewing the interviews below is highly recommended. Both interviewees have predicted epic crashes for the S&P 500 in 2024:

- John Rubino, “Bear Market, Recession, Layoffs: Lots of Ways For 2024 To Get Worse”, January 8, 2024

- Henrik Zeberg, “Market Crash Will be Worse Than 1929!”, January 6, 2024

The video “Strategy to Protect against new S&P lows caused by Deflation Surprise“ below covers my recommended defensive growth strategy that should be deployed by all investors.

Attending my “Markowski on the Markets” (MOTM) weekly session is highly recommended. Sessions are held every Saturday at 11:00 AM Eastern and are FREE. The sessions cover the trend changes for the market and the economy as compared to the previous week. Updates for commercial real estate by Alan Kaye are also covered biweekly or monthly. Also covered are the recommended private and public companies with 10X to 100X upside potential that are utilized for the deployment of the defensive portfolio growth strategy that is explained in the video above.

Click below to register for MOTM

Michael Markowski, a 47-year financial markets veteran, is the Director of Strategies for AlphaTack, whose slogan is “growing assets against the wind”. He conducts empirical research of the past, which he then utilizes to develop algorithms to predict the future. His research of Enron’s Financial Statements after its infamous bankruptcy led to the development of a Cash Flow Statement algorithm. The algorithm was utilized to predict a “day of reckoning” for Lehman, Bear Stearns, Merrill Lynch, Morgan Stanley and Goldman Sachs in a September 2007, Equities Magazine article. Michael’s research of prior market crashes led to the development of the Bull & Bear Tracker (BBT) algorithm. From 2018 to 2022, the BBT gained 177% vs. the S&P 500’s 50%. His predictions of all periods of heightened market volatility from 2008 to 2022 and that S&P 500 at March 23, 2020 had reached its bottom which was exact are media verifiable.