Apollo Global Management Inc. is rolling out three new private capital funds for wealthy individual investors in Europe, intensifying the competition for a group seen as key to the growth of private markets.

The three new funds will broaden access to Apollo’s European private credit, global diversified credit and private markets secondaries offerings, with clients able to invest in each for as little as €10,000 ($11,791), according to Véronique Fournier, Apollo’s head of EMEA wealth distribution. Investors will have monthly opportunities to put in new capital and a quarterly redemption limit of 5%, she said.

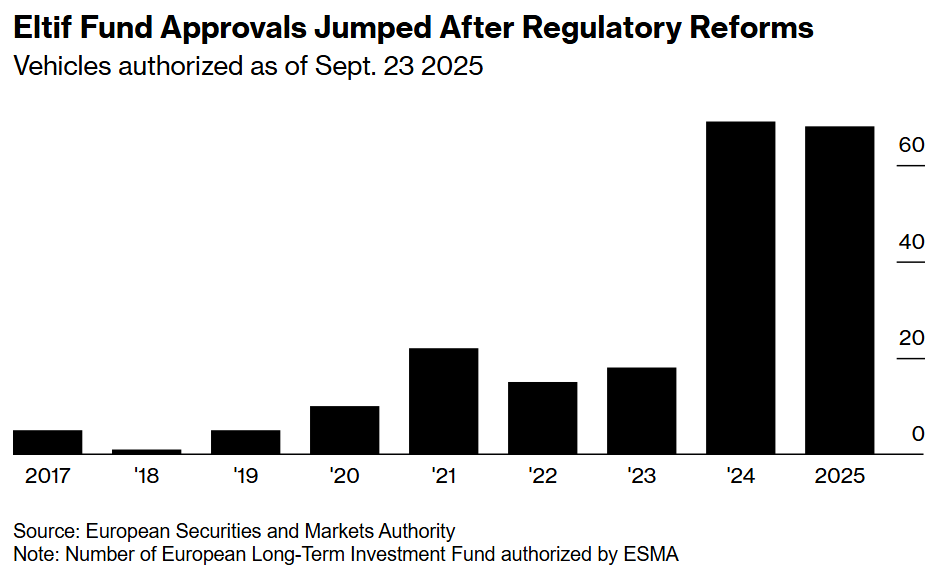

This type of evergreen fund has been surging in popularity in Europe recently after regulatory changes made it easier for individuals to access an asset class traditionally dominated by institutional investors and the ultra-wealthy.

The new rules for European Long-Term Investment Funds — known as ELTIF 2.0 — removed minimum investment requirements while offering more liquidity than traditional closed-end structures that typically lock up money for years. The changes have also broadened the type of assets that fund managers can hold.

“Now ELTIFs can deliver across Europe, from ultra-high net worth to retail,” said Fournier. “With ELTIF 2.0 you can offer a monthly ability to trade-in and a quarterly ability to trade out with a 5% cap on outflows.”

At the same time, private capital managers are keen to find new areas of growth, and see Europe’s wealthy as a fertile source of fresh funds. Deutsche Bank AG said this week that it’s launching a private markets fund in collaboration with DWS Group and Swiss buyout firm Partners Group Holding AG that will be available for wealthy clients soon.

Others vying to win individual investors in the region include Blackstone Inc. and Ares Management Corp. Blackstone’s European private credit fund for wealthy individuals, ECRED, has €2.7 billion in total assets, while Ares’ European Strategic Income Fund has €4.6 billion in assets, according to the firms’ latest fact sheets.

Apollo estimates that there is a $15 trillion opportunity across Europe and the Middle East for household assets, which includes personal investments, savings and cash. “It’s a huge market which today is much more accessible for private capital managers, and with an investor base that increasingly wants to access private markets,” Fournier said.

The New-York based asset manager expects to launch the three funds in coming months.

Written by: Silas Brown and Leonard Kehnscherper @Bloomberg

The post “Apollo Targets Wealthy Europeans With New Private Capital Funds” first appeared on Bloomberg