State Street Corp.’s asset-management arm acquired a minority holding in Coller Capital to tap the growing market for secondhand stakes in private markets.

The firms announced the deal Monday in a statement that didn’t disclose the amount of the investment. The proceeds will be reinvested in Coller’s business and won’t affect the firm’s day-to-day management.

“Secondaries and private markets represent an important and growing opportunity,” State Street Investment Management Chief Executive Officer Yie-Hsin Hung said in the statement.

Hung has sought to push into alternative assets since taking over the unit in 2022, and she previously said it was in the market to buy a private-credit firm. Boston-based State Street, which mostly invests in stocks and bonds through passive funds, has joined other traditional asset managers that are seeking to diversify away from those products, whose popularity is declining.

In addition to its investment in secondaries specialist Coller, State Street recently moved to expand in other areas, an effort that includes a partnership with Apollo Global Management Inc.

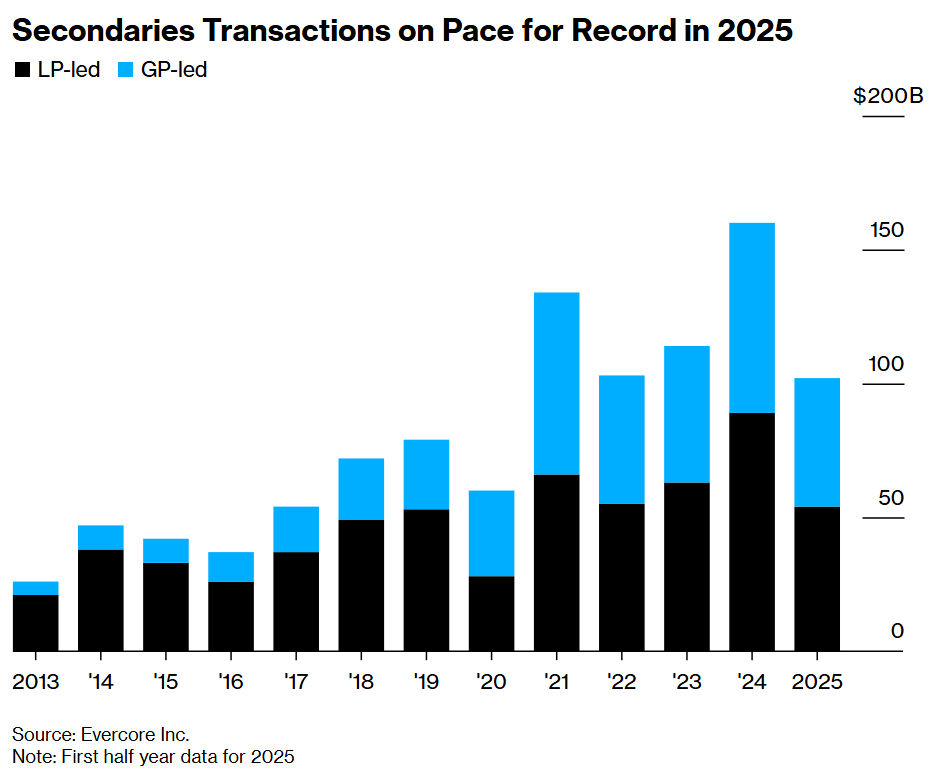

The secondhand market for private stakes has ballooned, with transactions on pace to eclipse $200 billion this year, up from $162 billion in 2024. Volume could approach $500 billion in five years, as investors increasingly view secondaries as a strategic component of their asset allocation, according to the statement.

Investors in private funds, known as limited partners, have tapped the secondary market to sell parts of their portfolios to improve liquidity. General partners, which manage the funds, are also increasingly turning to the secondary market to raise continuation funds to hold on to some of their assets for longer.

Coller, which manages more than $46 billion of secondaries assets, will be able to reach more institutional and retail investor bases worldwide following its deal with State Street.

While London-based Coller has primarily invested in private equity secondaries in recent years, it also added a credit secondaries strategy, for which it raised $6.8 billion as of July.

Goldman Sachs Group Inc. served as financial adviser to State Street, which received legal advice from Sullivan & Cromwell and Ropes & Gray. Morgan Stanley was Coller’s financial adviser, while Kirkland & Ellis was legal adviser.

Written by: Preeti Singh and Loukia Gyftopoulou @Bloomberg

The post “State Street Takes Coller Capital Stake to Tap Secondaries Boom” first appeared on Bloomberg