Appetite for equities is subsiding among the big-money crowd amid anxiety that a record-smashing rally is becoming too hot. That may be just what this bull market needed.

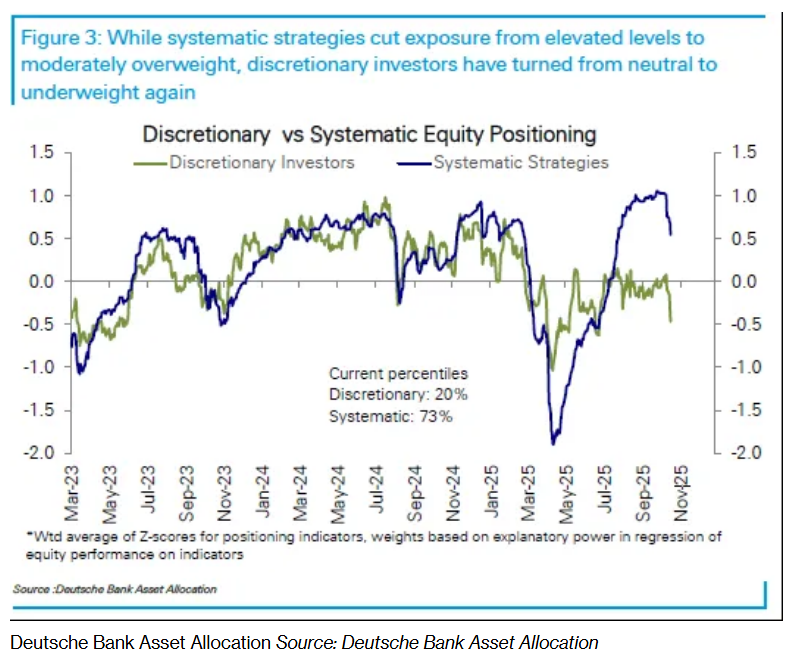

Models of investor positioning show computer-based and discretionary funds recently cut their stock exposure by the most since early April, when President Donald Trump’s tariff threats sent the S&P 500 Index teetering near a bear market. And hedge funds have pushed a measure of their risk appetite known as net leverage toward the lowest quarter of readings going back three years ago.

With euphoria running rampant among the retail crowd as the S&P 500 powers toward its sixth consecutive monthly gain, professional allocators’ skepticism may offer a tonic for those fretting over signs the rally is approaching unsustainable levels. From a contrarian perspective, the cash the group is keeping on the sidelines may turn into fuel for a further rally in stocks.

“Positioning is remarkably light given how far and fast the market has run,” said Brian Nick, head of portfolio strategy at Newedge Wealth. “There is a possibility of a chase into year-end considering earnings remain resilient and the economy is not falling off the cliff.”

Several factors underpin the latest bout of skepticism among big-money funds. The US government shutdown shows no signs of ending, trade tensions with China are lingering and caution is brewing around the artificial intelligence rally that’s plowed trillions of dollars into companies involved in the technology.

At Deutsche Bank AG, a gauge of aggregate equity positioning dropped from moderately overweight to neutral in the steepest weekly reduction since early April, the firm’s strategists wrote in a note to clients on Oct. 17. Stock exposure among discretionary investors — the group that’s been cautious for several months now — fell to “notably” underweight from neutral, they said.

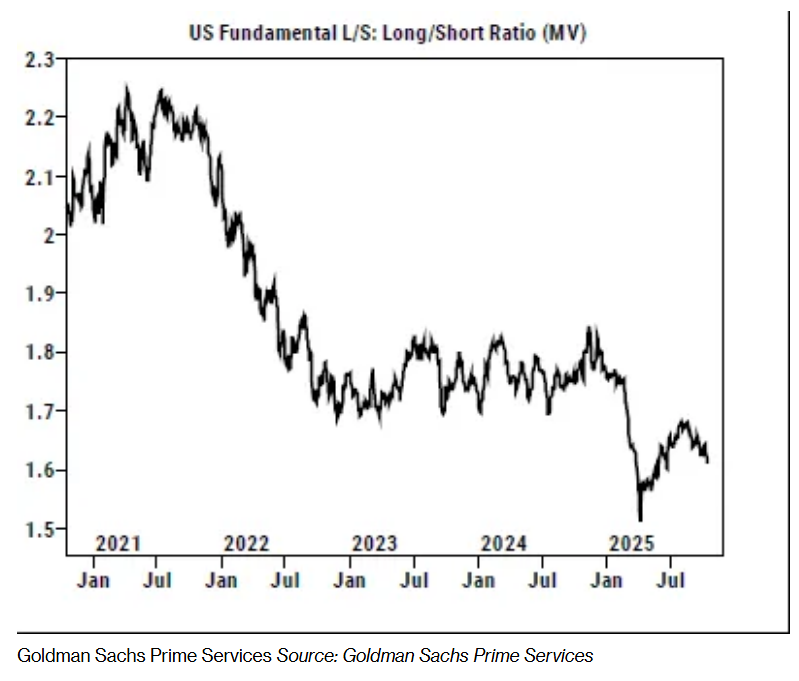

Risk-off sentiment was particularly pronounced among so-called “fast money” investors. Long-short hedge funds reduced net leverage, which measures long versus short positions, to 50.7% in the past few days — below 74% of observations going back three years ago, according to Goldman Sachs Group Inc.’s prime-brokerage desk. As the S&P 500 gained more than 1% last week, the cohort offloaded stocks at the fastest pace since early April.

A jump in volatility on Oct. 10, when trade tensions suddenly flared after subsiding in prior months, pushed the so-called systematic funds to the sidelines, according to data compiled by Nomura Securities International Inc.

“The aggregate systematic exposure was reduced from vol control funds specifically off the back of that one day selloff that forced mechanical deleveraging,” wrote Charlie McElligott, cross-asset macro strategist at the firm. The Cboe Volatility Index — which rises when demand for hedges on the S&P 500 Index increases — has been hovering near 20, a level that often signals mounting market stress, since then.

Two weeks into earnings season, corporate America has provided investors with few reasons to worry, even as the economy is showing signs of cooling. Companies in the S&P 500 grew their profits by 8.5% in the third quarter, according to data compiled by Bloomberg Intelligence so far in the reporting season. About 85% of S&P 500 members that have reported results so far have surpassed profit estimates, on course for the best showing since 2021.

“Analysts cut forecasts too deeply after Liberation Day, but resilient second-quarter results forced them to revise their third-quarter estimates higher,” said Wendy Soong, Bloomberg Intelligence equity strategy analyst.

That’s further reassured retail traders, the cohort that’s bought every stock-market dip this year. The non-professional crowd bought call options at a record pace earlier this month. And Citigroup Inc.’s data show that on Tuesday, retail traders were responsible for 16% of total single-stock trading volume, the most on record in data stretching back to 2018.

To Max Gokhman, deputy chief investment officer at Franklin Templeton Investment Solutions, resilient corporate earnings and further signs that more Federal Reserve easing is on the way should push institutional investors to follow suit.

“A spark of volatility last week spooked some fast-money bulls, and overall investor positioning is now more modestly risk-on,” Gokhman said. “This could be an excellent set-up for the upcoming deluge of earnings, which I expect to be generally positive, and an all but certain Fed cut amidst a macro backdrop that remains supportive.”

“Should these positive trends coalesce to send stocks higher, investors will see there’s more treats than tricks left in this market,” he added.

Written by: Natalia Kniazhevich @Bloomberg

The post “S&P 500 Rally’s Next Leg Seen Fueled by Big Buyers on Sidelines” first appeared on Bloomberg