South Korea’s stock benchmark pared losses after a sharp afternoon rebound as retail investors bought on the dip, offsetting some of the earlier selling driven by valuation concerns.

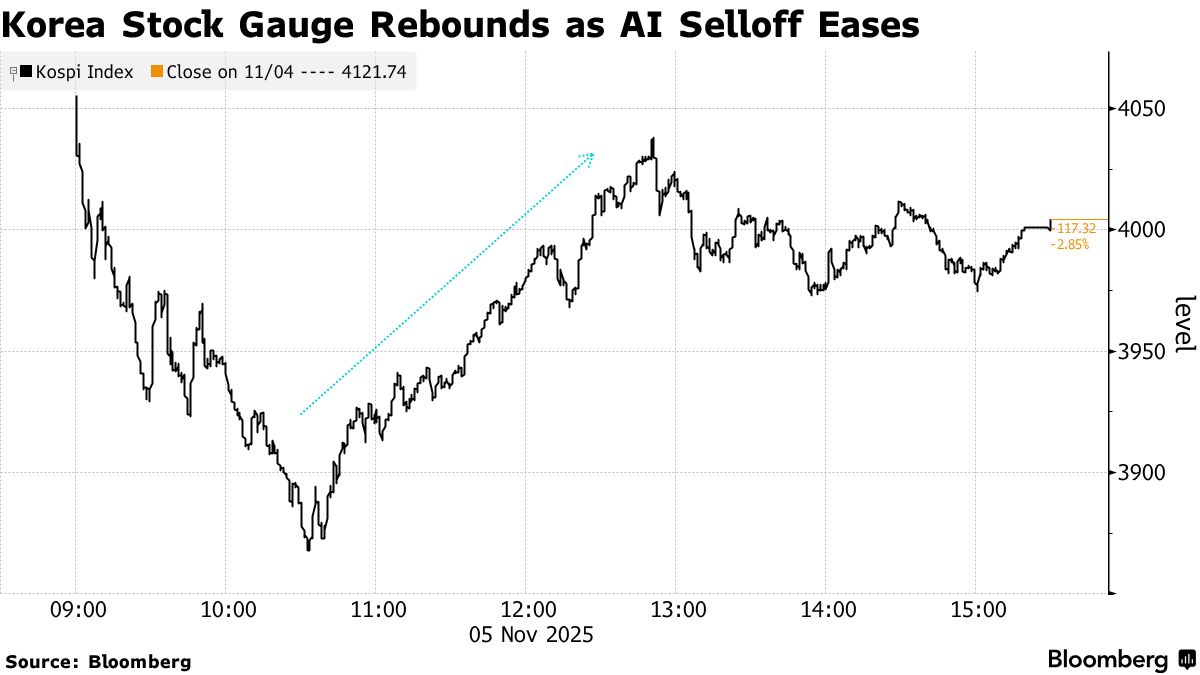

The Kospi Index fell 2.9% on Wednesday, its steepest drop since August, after recovering from an intraday loss of as much as 6.2%. Index heavyweights Samsung Electronics Co. and SK Hynix Inc. led the decline, though both also trimmed steeper losses from earlier in the session.

The day’s finish points to growing unease over stretched valuations in tech-heavy markets, a concern that’s gaining traction globally. The afternoon rebound led by retail dip-buyers also suggests that artificial intelligence-fueled optimism remains resilient, with investors still eager to participate in another potential rally.

“I think this is a healthy correction,” Jongmin Shim, deputy head of Korea research at CLSA, said on Bloomberg TV. “There have been ongoing concerns in AI, and Kospi obviously has had very strong performance in October.”

The Korean market opened sharply lower, mirroring a 1.2% drop in the S&P 500 overnight after Wall Street leaders warned of a potential correction. The Korea Exchange, the country’s bourse operator, briefly halted sell orders for program trading in the morning after Kospi 200 futures plunged more than 5%.

The won also weakened by as much as 0.6% against the dollar as foreign investors sold local stocks.

By afternoon, retail buyers stepped in to stem the benchmark’s slide, scooping up a net 2.6 trillion won ($1.8 billion) in Kospi shares even as foreign and institutional sellers continued to sell.

“Since no significant fundamental warning signs have been observed, we believe that a buy-on-dip strategy remains valid,” said Seokkeun Ha, chief investment officer at Eugene Asset Management Co. in Seoul. “The strategy of buying leading stocks at low prices in leading sectors remains effective.”

South Korean stocks surged about 20% in October, making the market one of the world’s top performers. Despite the rally, some analysts still see valuations as attractive, given strong earnings prospects and President Lee Jae Myung’s corporate reform drive.

Momentum has also been driven by Korean tech firms’ pivotal role in the global AI supply chain. The market’s latest leg-up came from Nvidia Corp. CEO Jensen Huang’s visit to Korea, where he struck several deals with local conglomerates.

But concentration risks intensified as Samsung and SK Hynix drove a large portion of the Kospi’s surge in October. SK Hynix alone spiked more than 60% last month, fueled by strong earnings that underlined AI-driven chip demand. The sharp run-up triggered the Korea Exchange to issue a rare “investment caution” on the stock.

“After a 20% jump in October alone, there has been investor fatigue and then the AI bubble theory raised concerns,” said Huh Jae-Hwan, a strategist at Eugene Investment & Securities. “There definitely are pockets that resemble a bubble.”

Shawn Oh, an equity trader at NH Investment & Securities Co., said he began receiving a surge of inquiries about potential market weakness starting late Tuesday. But he noted that investors aren’t panicking and calm had returned to the trading room by late Wednesday morning.

“I can hear my program desk talking about circuit breaker,” Oh said. “I was jammed in early trading. No panic today but definitely selling AI-linked stocks and outperformers.”

Written by: Youkyung Lee and Sangmi Cha — With assistance from Susie Kang @Bloomberg

The post “South Korean Stock Selloff Eases as Retail Traders Buy the Dip” first appeared on Bloomberg