Based on a Securities & Exchange Commission (SEC) change in regulations publicly traded companies at valuations of less than $10 billion will be extinct by 2030. Penny stocks and shares that are priced below $10 will also become memories from the past. To be publicly traded a company will have to have a minimum valuation of $10 billion.

A follow on SEC regulatory change will result in startup and early stage private companies replacing the existing publicly traded micro to mid-cap classifications in the above table. Privates will become the primary source for growth investment allocations for portfolios also by 2030.

The 2010 passage of the Dodd Frank Act resulted in the most significant new regulation for the capital markets since the SEC was formed in 1934. It was because Dodd Frank invoked criminal liability for fiduciaries who advise their clients or make investments for them which subsequently decline. Prior to Dodd Frank a client complaint could only be settled via a civil arbitration.

Dodd Frank resulted in the extinction of the stock broker. Almost every fiduciary has fled the brokerage industry and to become a registered investment advisor (RIA). RIAs who receive a percentage of the assets managed fee, instead of a brokerage commission, are also known as wealth managers.

The act also resulted in fiduciaries fleeing smaller company investment opportunities. A fiduciary has significantly less liability and a much stronger defense when recommending or investing in a bonafide blue chip which declines in value.

The resultant dearth of cash for small companies as depicted in the table below resulted in the performance of the Russell 2000’s ETF (symbol:IWM) lagging the S&P 500 from July of 2010 to 2025. The table also depicts that the Russell outperformed the S&P 500 from the 2000 dotcom bubble high to 2010.

An August 16, 2020 article “Small stocks no longer deliver big gains for US investors” in the Financial Times covered the new phenomena for the U.S. capital markets which was caused by Dodd Frank.

The chart below depicts the performance of the Royce Micro-cap fund which contains companies with market caps of $500 million and less. The chart illustrates the significant widening of the performance spread for the fund and the index after Dodd Frank was passed in 2010. The chart better illustrates the impact of the regulatory change since the Russell 2000’s largest member has a market cap of $7.1 billion.

The 2010 regulatory change also resulted in fiduciaries concentrating client investments into the largest U.S. companies. The table below depicts that S&P 500’s 10 largest companies account for 38% of the index, the highest percentage since data has been available (1880). See, Charted: S&P 500 Market Concentration Over 145 Years. The top 10’s representation has increased by 100% as compared to 2010. The table below contains the concentrations at all of the index’s secular bull highs since 1929.

Dodd Frank will also result in the active asset manager becoming a rarity by 2030. The chart below depicts the significant widening of the spread for active vs. passive assets under management (AUM) since 2012.

The active to passive assets managed shift recently went to the top of my list as a catalyst that will inevitably wreak havoc. I only learned about the problem that passive poses from viewing a one hour interview of Michael Green. He is a portfolio manager, CFA and Chief Strategist for Simplify Asset Management. The four minute “Active to Passive KILLING Market for Stocks” video below is a clip from his one hour interview. The clip is a must view for any and every investor who has a 10 years or more investing time horizon. A view of the entire one hour “Precursors to Eventual Mayhem” interview is highly recommended.

Active to Passive KILLING Market for Stocks

Precursors to Eventual Mayhem

To counter Dodd Frank, the US Congress passed the JOBS Act in 2012. Legislation was needed to fill the vacuum for the US economy that was left by the inability for small publicly traded companies to easily raise growth capital. The JOBS Act facilitated startup and early stage private companies to more easily raise capital from everyone including the masses. The act also included provisions for secondary market liquidity for private companies.

My research of the 2010 and 2012 acts resulted in Dynasty Wealth (DW) being founded. DW’s mission is to identify infant and adolescent unicorns which have the potential to become centicorns.

Upon their being identified DW advises and assists them to obtain funding via a perpetual financing strategy that was utilized by UBER and Airbnb. DW also assists to provide liquidity for the shareholders of the companies.

The table below contains the four that have been identified and their addressable markets. Their achievable valuations, which are determined from analyses conducted by Dynasty Wealth, range from $250 billion to $1.0 trillion. RYPPLZZ which has the most upside potential is projected to reach a valuation of $10 billion by end of 2026. See “911 to Catapult RYPPLZZ to $10 billion by 2026”.

Dynasty Wealth (DW) is serious disruptor to the VC industry since it can provide cash to its portfolio companies much faster and at increasingly higher valuations. The 34:38 minute video ““DW Uberizing VC Industry” is highly recommended. Below are three parts of the video and the subject matter covered.

Part 1, 11:23 min

- Visionary Analyst Michael Markowski’s research and algorithm development methodology and track record, 00:00 – 4:02 (4:02)

- Explanation of 2010 Dodd Frank Act & 2012 JOBS Act 4:03-11:23 (7:20)

Part 2, 10:10 min

- Dynasty Wealth’s mission

- Dynasty Wealth’s perpetual financing strategy reduces dilution for Jr. Centicorns

Part 3, 11:35 min

- “Vanguard Effect”, key catalyst for ten to 20 years S&P 500 Decline

- Momentum for pros to invest in private growth companies accelerating

- Rationale in support of half million to billion by 2032 fund opportunity

For information about Fund click to submit contact information.

See “Digital Fund, 2nd chance for $500K to Billions“.

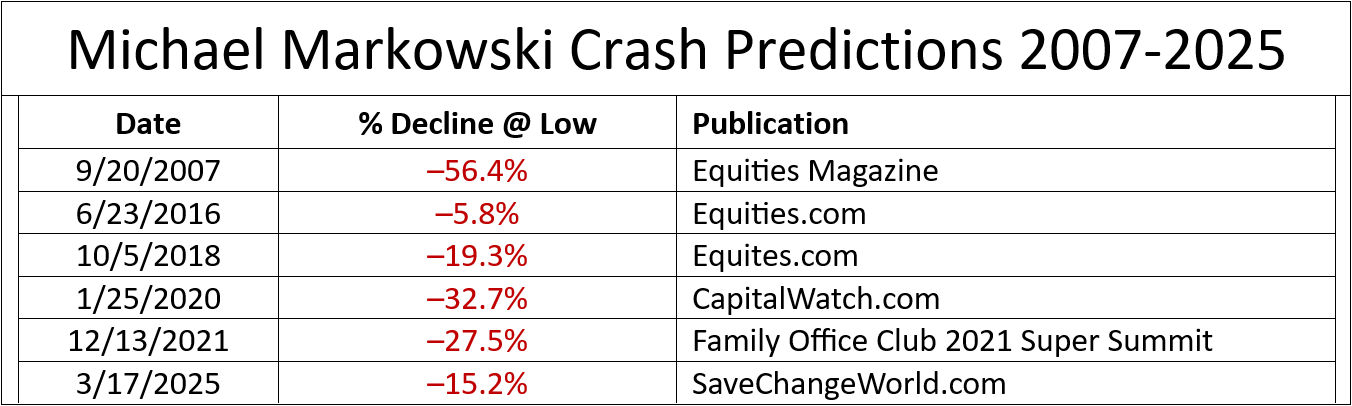

Michael Markowski, Director of Research for AlphaTack.com. Developer of “Defensive Growth Strategy”. Entered markets with Merrill Lynch in 1977. Named “Top 50 Investor” by Fortune Magazine. Formerly, underwriter of venture stage IPOs, including one acquired by United Health Care for 1700% gain. Since 2002 has conducted empirical research to develop algorithms which predict the negative and positive extremes for the market and stocks. Has verifiable track records for predicting (1) bankruptcies of blue chips, (2) market crashes and (3) stocks multiplying by 10X. In a 2007 Equities Magazine article predicted the epic collapses for Lehman, Bear Stearns and Merrill Lynch. Most recent algorithm developed from research of UBER and AirBnB has enabled identification of startups having 100X upside potential within 7 to 10 years.