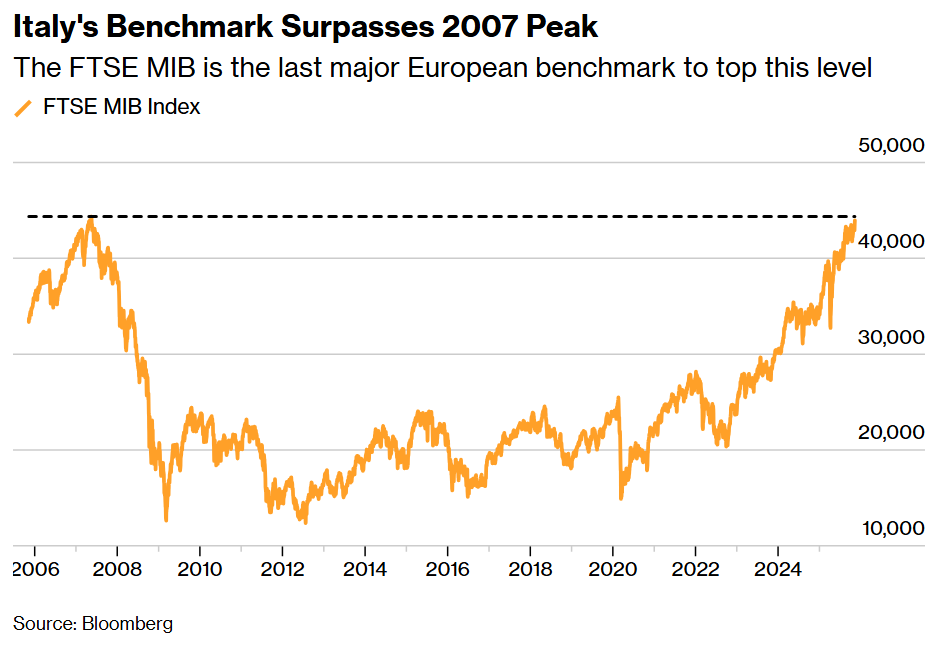

Italy’s equity benchmark surpassed its 2007 peak, becoming the last major European index to reclaim declines triggered by the global financial crisis.

The FTSE MIB Index — home to banks such as UniCredit SpA and defense firm Leonardo SpA — gained as much as 1.1% to 44,372.74 points on Tuesday, rising above a peak of 44,364 points hit in May 2007. The gauge is now trading around the highest level since 2001.

Italian stocks have finally been in favor this year as investors flocked to sectors exposed to the domestic economy in an attempt to escape harsh US tariffs. The FTSE MIB has rallied 30% in 2025, beating the Stoxx Europe 600 Index’s 14% advance. Banks have led the gains amid confidence in the regional economic recovery and a stable outlook for interest rates.

Still, the benchmark has a long way to go before catching up to its record high of 50,109 set in 2000. Other European benchmarks, including Germany’s DAX and the UK’s FTSE 100, are already scaling all-time highs.

Lenders including UniCredit, Intesa Sanpaolo SpA and Banco BPM SpA are among the biggest drivers of the FTSE MIB index this year. Utility Enel SpA and insurer Generali are also among the top contributors by points.

Written by: Sagarika Jaisinghani @Bloomberg

The post “Italy’s FTSE MIB Finally Recoups Declines Since Financial Crisis” first appeared on Bloomberg