My assumption is that you have read and have digested 10/06/25 “Empirical Research, Why Dynasty Wealth Is Premier Family Office Strategist” report and videos contained in it. If so, you are aware that the Dynasty Wealth (DW) investing community has, or will soon have, the following ingredients to be utilized to support billions to be deployed into a defensive growth strategy:

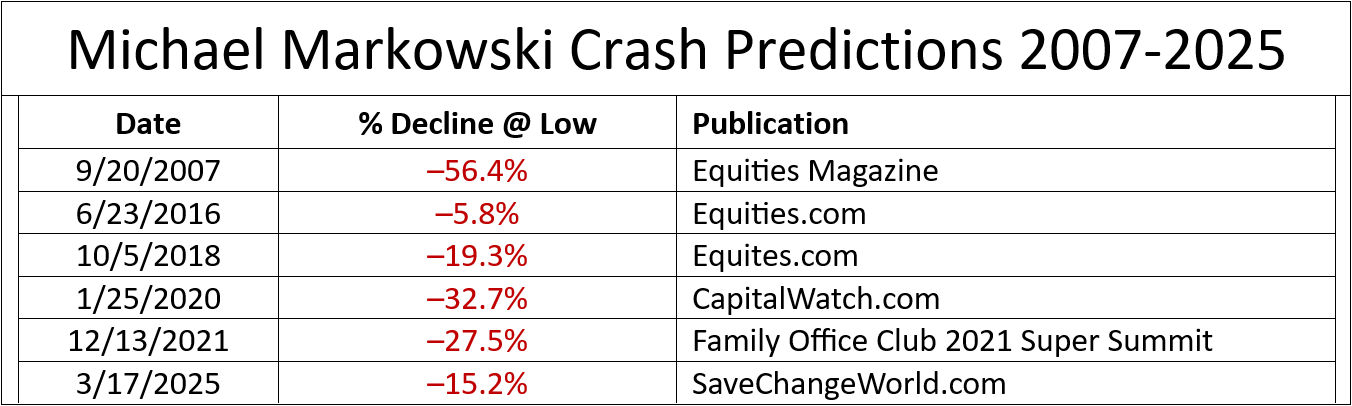

1. Expertise and track record for predicting and capitalizing from stock market declines.

2. System to identify and finance startups from valuations of less than $50 million to $1.0 billion within five to seven years.

3. Has identified four early stage companies which have potential to reach $10 billion valuations by 2030 and $100 billion by 2033.

4. Track record for four companies reaching valuations of $1.0 billion, equivalent to minimum 40X gains for DW ‘s participating seed round members, by as early as 2026 and as late as 2027.

5. Track record for enabling liquidity for the shareholders of the Liquid Hyper Growth Strategy (LHGS) fund and also the private companies that are held by the funds. This is to be accomplished by fund filing an S-1 registration statement with SEC by end of 2025 to enable it to become first publicly traded ETF holding and investing in adolescent unicorns, decacorns and centacorns.

6. Share price for publicly traded fund containing the DW companies that has multiplied by 10X by end of 2026 and 100X at end of 2027. For why fund shares projected to increase by two times by end of 2025 see 11/06/2025 “RYPPLZZ: Dynasty Wealth’s 1st Adolescent Centacorn to $250M”.

The bottom line is that Dynasty Wealth has a model and most especially has a proprietary hook that can attract an aggregate of $100 billion of managed assets into defensive growth funds or portfolios. Its quite feasible for the AUM to be reached by end of 2026. For this to happen large investors and most especially generational, which include family offices, foundations and endowments, etc., will need to be become educated about the following:

- Problem – S&P 500 faces 10 to 20 years of subpar or declining returns. By the way, Vanguard in its 10/26/25 report surfaced same problem and recommended a solution.

- Solution – Defensive Growth Strategy which is the solution for the problem and that DW is the key for the strategy’s venture capital allocation.

The underlying issue is that timing is of the essence. For many reasons, a precipitous decline for the US market could begin sooner rather than later. For this reason, DW is willing to incentivize influencers or in essence share the wealth. This would include an influencer having the option to receive an equity stake in DW. The table below depicts the value of DW assuming the four existing companies reach DW’s projected achievable valuations.

Please note. DW receives a dilutable 4.9% equity stake fee from each startup or early stage company the becomes a member of its community. Thus, DW is highly motivated to minimize the dilution from financings for each of its member companies.

DW has the potential to become among the most valuable entities in the world and to reach valuation of a trillion or more. By 2030, DW’s investing community has a high probability for being recognized as the premier VC for companies with $100 billion or more potential. There could be dozens if not hundreds of companies throughout the world which could become members of DW.

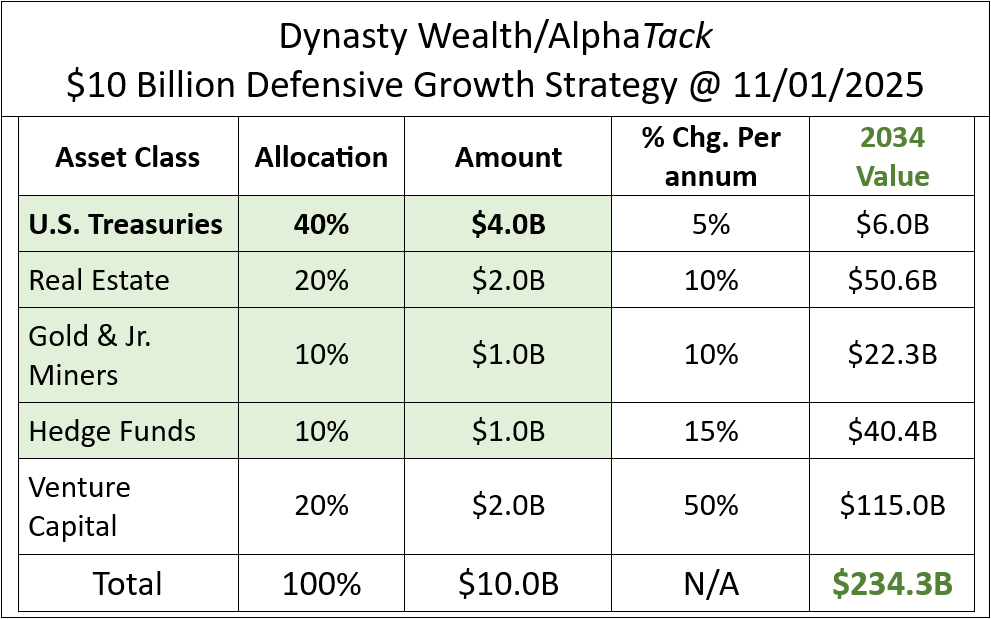

The green shaded allocations in the table below depict the portions of the $10.0 billion of AUM that are not managed by DW. The professionals who can manage the allocations can partner with DW which would enable them to increase their assets under management. Other venture capital funds can also partner with DW.

A minimum of $10 billion of AUM (assets under management) by end of 2026 could be attainable for two reasons:

- The hook that will drive the majority of the increase in value is the 100X to 1,000 X upside opportunities that DW identifies and supports. Approximately half of the $234.3 billion of value created from $10 billion by 2034 is represented by the Dynasty Wealth VC allocation. To get access to DW’s venture capital component will require that the investor acquire shares in a defensive growth fund that is affiliated with Dynasty Wealth. For more about DW’s alpha VC component and the LHGS fund see “Rationale for Half MILLION to BILLION by 2032″.

- Professional managers for the non DW managed allocations in the table above will be required to market and sell the defensive growth strategy to their contacts and prospects. What they will market is their tailor made defensive growth fund. In the alternative they can market a defensive growth fund that is managed by a DW affiliate to their contacts, which includes their allocation. For example, I am now in discussions with a real estate asset manager which has $750 million of assets under management (AUM). The majority of their AUM has come from family offices. Upon them introducing DW to their family offices and other contacts their AUM will increase substantially.

Michael Markowski, Director of Research for AlphaTack.com. Developer of “Defensive Growth Strategy”. Entered markets with Merrill Lynch in 1977. Named “Top 50 Investor” by Fortune Magazine. Formerly, underwriter of venture stage IPOs, including one acquired by United Health Care for 1700% gain. Since 2002 has conducted empirical research to develop algorithms which predict the negative and positive extremes for the market and stocks. Has verifiable track records for predicting (1) bankruptcies of blue chips, (2) market crashes and (3) stocks multiplying by 10X. In a 2007 Equities Magazine article predicted the epic collapses for Lehman, Bear Stearns and Merrill Lynch. Most recent algorithm developed from research of UBER and AirBnB has enabled identification of startups having 100X upside potential within 7 to 10 years.