ABOUT ALPHATACK

AlphaTack (AT) is presently owned and operated by Dynasty Wealth and is in the process of being converted into an institute and non-profit corporation. The plan is for AT to be 100% objective so that it can assist its generational investor members to protect and grow their portfolios into perpetuity. Generational investors which have 100 years plus investing time horizons include the following:

- Family Offices

- Sovereign Wealth Funds

- Foundations

- Endowments

- Public Pension Plans

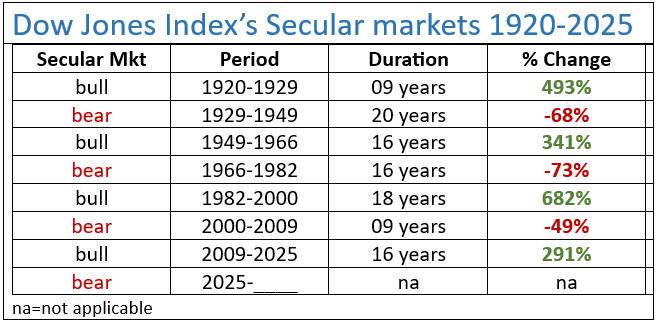

A/T conducts ongoing empirical research to develop algorithms and strategies to enable investors to PROTECT and GROW their assets throughout all economic and market conditions. A/T has the expertise to track and predict secular markets:

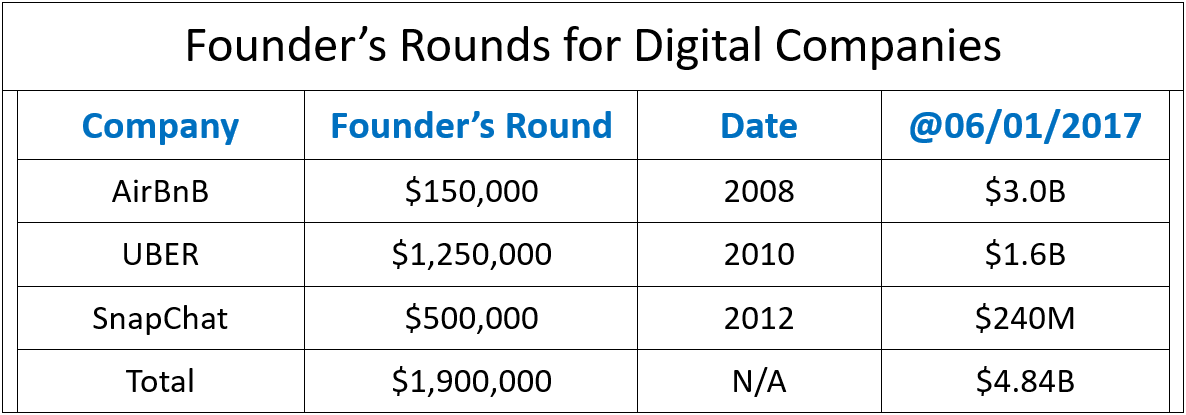

AT has also conducted research on the transformations for the global economy which have occurred since the 17th Century. The transformations have enabled the savvy to produce generational or dynasty wealth. The tables below are from the research that AlphaTack has conducted on companies and their shareholders which have benefitted from the transformation to the digital from the industrial economy. The transformation has been underway since the invention of the Internet in 1983. The table below depicts the amounts that were invested in the founder’s rounds of the three digital companies from 2008 to 2010. The $1,900,000 of aggregate investments into the founder’s rounds of the four companies was valued at $4.8 billion in 2017.

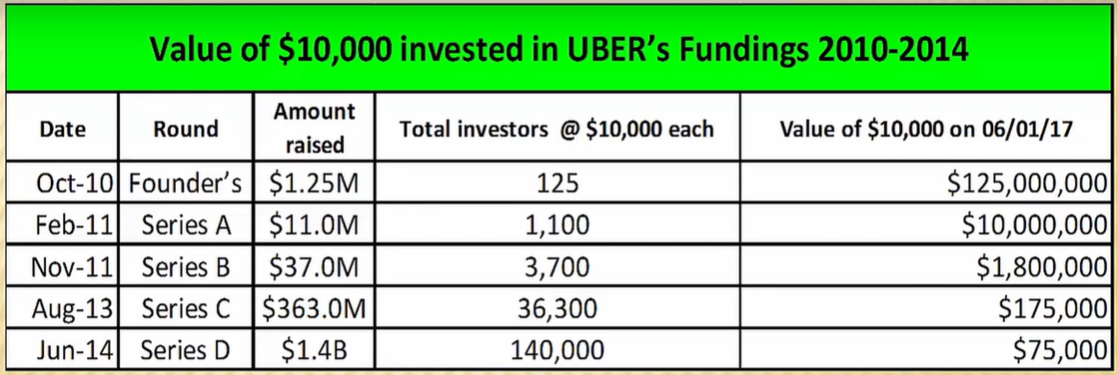

Table below depicts the value for $10,000 invested in each of UBER’s founder through Series D rounds in 2017.

Please note. Founder and pre-IPO rounds for startup and early stage companies exclusively available to AlphaTack members and funds that are affiliated with AlphaTack. A good example of how startups and early stage companies are allocated is depicted in the table below. The startups are utilized to invest in the venture capital allocation for AlphaTack’s defensive growth portfolio. t allocated to the venture capital silo for to the funds and investors which deploy AlphaTack’s defensive growth strategy. The startups are projected to account for 99% of the gain in the AT portfolio through 2034. To attend a ZOOM session which explains the strategy click here.

AlphaTack & Defensive Growth Strategy

The following reports are highly recommended: