Traders should take cover from a protracted selloff in the dollar that could mirror the boom-and-bust cycle of the Internet bubble once the drivers that are supporting the currency turn into headwinds, according to RBC Capital Markets.

The greenback has already been hit hard this year by the uncertainty associated with President Donald Trump’s policies. But it found support from a soaring stock market and US asset allocations from global investors, chief among them mammoth, passive investment funds.

Over the last two decades, these global players have favored increasingly-expensive US assets, particularly stocks, with flows in turn favoring the dollar, RBC currency strategist Richard Cochinos, said.

“This concentration worked well in the past 15 years but poses risks in the current environment,” Cochinos wrote in a note. “A measurable change in demand (and relative performance) can have profound implications in FX.”

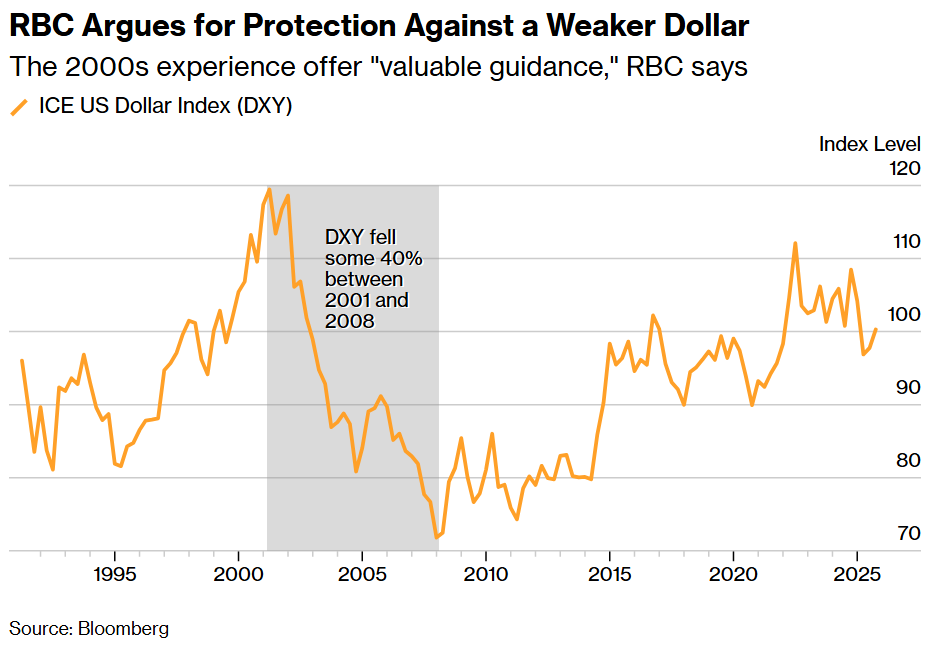

Once capital diversifies out of a shock, as it happened after the Internet bubble deflated in 2000, it would presage a deep downturn in the greenback — similar in scope to the US currency’s 40% peak-to-trough decline from 2001 to 2008, he wrote.

Cochinos also listed high valuations, changing trade paradigms and shifting safe havens among challenges for the dollar over the next few years, noting that “longer-term tail risk management should be top of mind as we move into 2026.”

To hedge against a longer-term decline in the dollar’s value, RBC recommends traders tap a range of strategies — from synthetic call options on the ICE US Dollar Index to bullish binary options on the euro and yen. They also recommend more plain-vanilla structures including:

- A two-year call on EUR/USD with a strike at 1.30 (a roughly 12% drop in dollar)

- A two-year put on USD/JPY with a strike at 130 (a roughly 15% drop in dollar)

The RBC analysis also highlights how today’s environment differs from the 2000s, particularly given the rise of illiquid and private-asset investing that can exacerbate swings across financial markets during times of market stress.

“The historical lessons from the post-2000 period provide valuable guidance, but today’s unique combination of technological change, geopolitical tension, and monetary policy experimentation requires some adaptation as allocation frameworks are no longer traditional,” Cochinos wrote.

Written by: Carter Johnson @Bloomberg

The post “Dollar Faces Risk of 2000s’ Boom-and-Bust 40% Decline, RBC Warns” first appeared on Bloomberg