Palantir Technologies Inc.’s pricey valuation has long confounded Wall Street but investors have largely ignored those calls, instead pushing the stock to yet another record ahead of earnings.

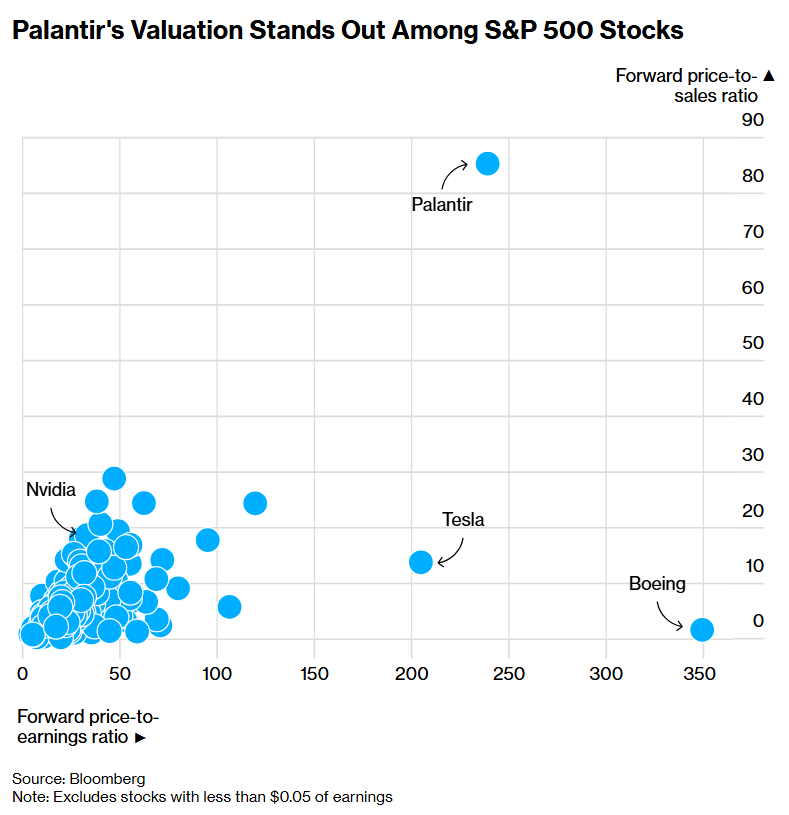

The shares were priced at 85-times sales expected over the next 12 months, as of Friday, making them by far the most expensive in the S&P 500 Index. Based on price-to-earnings, Palantir was the fourth-priciest company in the index after Albermarle Corp., Warner Bros. Discovery Inc. and Boeing Co. The stock was also the fifth-best performer in the S&P 500 this year with a 165% gain through Friday’s close.

The stock jumped as much as 3.5% on Monday ahead of results due after the close of trading, putting it on track to close at an all-time high.

Analysts expect Palantir to post a 50% increase in third-quarter revenue, with adjusted earnings per share jumping nearly 70%. Those are impressive numbers. But whether they’re enough to keep the rally going is another issue.

“Valuation is our big stumbling block,” said Morgan Stanley analyst Sanjit Singh, who has the equivalent of a hold rating on the shares. “The most expensive I’ve seen in my career.”

Concerns about the data analysis company’s hefty price tag are nothing new. Most analysts continue to shy away from full-throated recommendations, with twice as many assigning the stock sell or hold ratings than buy.

Beyond Wall Street, Palantir has a controversial reputation. Its involvement with government programs like immigration control, an AI fraud detection partnership with mortgage finance giant Fannie Mae and relationship with the Israeli goverment have all sparked criticism. And its Chief Executive Officer Alex Karp has himself been outspoken on various political topics.

A representative for Palantir didn’t immediately respond to a request for comment.

Palantir has a “great CEO, a legitimate business, and a great product,” said Vikram Rai, portfolio manager and macro trader at First New York. But its stock price is being fueled by broader trends lifting momentum plays rather than fundamentals, he said.

Others agree.

“When the music stops, this stock is going to get hit harder than others,” said Matt Maley, chief market strategist at Miller Tabak + Co. He applauds Karp and notes that Palantir is one of the few companies out there that’s making money from its AI investments. However, the stock price gives him pause.

“There are other AI plays which are cheaper, like Nvidia, that will be a little safer right now,” Maley said.

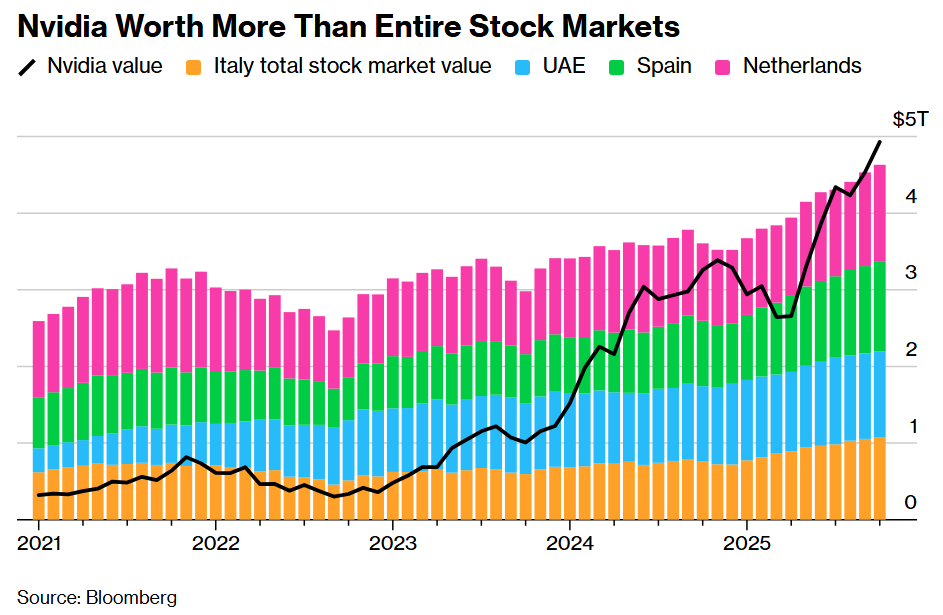

The most recent leg of Palantir’s rally came late last month, as Nvidia Corp.’s market cap topped $5 trillion after Chief Executive Officer Jensen Huang dismissed worry about an AI bubble and announced new partners, including Palantir.

Meanwhile, new deals with countries ramping up military spending keep coming, like the one Poland signed last week. The company is also bolstering its more overlooked commercial business, for example inking an agreement to provide AI software to telecom company Lumen Technologies Inc. Commercial clients accounted for 45% of Palantir’s revenue last quarter, with the other 55% coming from its government segment, according to data compiled by Bloomberg.

Palantir “will grow into its valuation,” tech bull Dan Ives wrote in a research note last week. Wall Street is “still underestimating the company’s commercial efforts,” he added.

On the commercial side, Gil Luria, managing director and head of technology research at DA Davidson & Co., expects strength because Palantir can “get their customers to an AI solution faster and more effectively than anybody else.” He’s kept his stock rating at neutral due to its high price, but doesn’t “see a reason for the valuation to come down right now either,” he said.

All of which makes this upcoming earnings report an important gauge for the company’s progress. First New York’s Rai said he sold some Palantir shares for a profit ahead of earnings but if the stock falls after these results, he’ll be back in the market.

“I would buy the next dip,” he said.

Not only is Nvidia the world’s most valuable company, with second-place Apple trailing by roughly $1 trillion, it’s also worth more than the combined value of stock markets in the Netherlands, Spain, UAE and Italy, according to data compiled by Bloomberg.

Top Tech Stories

- Alphabet Inc. is returning to Europe’s debt market for the second time this year with a multi-tranche sale, as the Google parent raises funds to support record capital spending on artificial intelligence and cloud infrastructure.

- Apple will kick off its 50th anniversary year with what’s expected to be a nearly $140 billion holiday quarter.

- The Chinese unit of Nexperia BV, a Dutch semiconductor company, has enough wafers stockpiled to fill orders for its customers, despite its parent company’s suspension of supplies to its assembly plant.

- A week that saw the Federal Reserve cut interest rates and dozens of US companies report earnings nevertheless boiled down to a single theme: artificial intelligence.

Earnings Due Monday

- Earnings Postmarket:

- Ichor Holdings Ltd. (ICHR US)

- Qorvo Inc. (QRVO US)

- Adeia Inc. (ADEA US)

- EverQuote Inc. (EVER US)

- Fabrinet (FN US)

- Harmonic Inc. (HLIT US)

- IAC Inc. (IAC US)

- Lattice Semiconductor Corp. (LSCC US)

- Palantir Technologies Inc. (PLTR US)

- RingCentral Inc. (RNG US)

- Sanmina Corp. (SANM US)

- Upwork Inc. (UPWK US)

- ZoomInfo Technologies Inc. (GTM US)

Written by: Felice Maranz @Bloomberg

The post “Palantir’s Unwavering Momentum Sends Valuation Into Stratosphere” first appeared on Bloomberg